High Monthly Rental Income

Serviced Apartments @

Hyderabad

Earn Rs.50,000 to 55,000 per month

by investing in Serviced Hotel Apartments in

Gachibowli, Hyderabad

On an investment of just Rs.72 to 81 lakhs

(all-inclusive of GST + registration + stamp duty + furniture & fitouts)

~ Home Loan Available from HDFC, Axis & ICICI ~

Construction is 90% Complete (RERA Registered)

Start earning from end of August 2023

3x GREATER Rental Income

than Normal Apartments

SAVE TAX (80C & 24)

Upto Rs.3,50,000 p.a.

ZERO MAINTENANCE

with 20 Year Lease

HOME LOAN AVAILABLE

from HDFC, ICICI & Axis

Managed by India’s Leading

Hotel Apartment Operator

EXPLODING DEMAND for

Hotel Apartments in India

Enjoy FREE HOTEL STAYS!

7 Free Days across India

SUCCESSFULLY Running @

Bangalore, Delhi & Cochin

OUTSTANDING LOCATION

In Hi-Tech City Phase 2

Construction is 90% complete

Trial operations expected to begin end of August 2023

The tower in the Middle is the Serviced Apartment Block – Starlit Suites Hyderabad is part of a 4 acre Gated Community consisting of 3 towers – 2 Residential (the towers on left and right) and 1 Serviced Apartment Block (in the center)

View of Starlit Suites Hyderabad tower from all 4 sides (1st coat of paint is done and 2nd coat will be done shortly and that will give the final look and finish to the building)

Short Story

A quick 2-minute overview to give you a complete picture.

Once you are done reading this, scroll down further to read a more detailed version.

Buying & renting out regular apartments will give you only 2.5% to 3% ROI per annum.

You can earn almost THREE TIMES AS MUCH (i.e. upto 8% per annum) by investing in these Serviced Hotel Apartments.

How Does this Work?

(in 3 simple steps)

Step 1

You invest in a fully furnished & air-conditioned 1 BHK hotel apartment that will be built like a 3 star hotel & will be registered in your name

(just like buying a regular apartment anywhere in Hyderabad)

Step 2

India’s largest serviced apartment operator (Starlit Suites, based out of New Delhi) will then market & operate this entire tower as a 3 star serviced hotel apartment for employees of top MNCs / corporates in & around Gachibowli to stay when they travel on work

Operator has rate contracts with leading online portals (makemytrip, Goibibo, etc) + travel agencies (such as SOTC, Cox & Kings, etc) + leading MNCs (such as Deloitte, Qualcomm, Novartis, Accenture, Amazon, Uber, Facebook, Apple, Wipro, TCS, Infosys, etc) to ensure high & consistent demand for rooms throughout the year.

Step 3

At the end of each month, total rental income of the ENTIRE tower (that is total revenue from ALL ROOMS PUT TOGETHER, BEFORE any expenses are deducted) is shared in a 50:50 ratio between you & the operator

(income is divided equally among all investors in the building)

This means you earn approx Rs.50,000 to 55,000 per month on an investment of just Rs.72 to 81 lakhs (of which 55% can be funded by home loan)

– a staggering 8% ROI per annum!

This is almost 3 times Greater Income than that of regular apartments anywhere in India – which is just 2.5% to 3% p.a!

1.

You earn income even if your room is VACANT / NOT OCCUPIED the whole month!

Since income from all the rooms is combined into a single bucket and then divided EQUALLY among all investors, you earn continuous income even if your unit is not rented out!

2.

Gross Income Sharing (not just Profit!)

You are paid 50% of total GROSS INCOME itself (that is total revenue BEFORE expenses are deducted) – which means the operator cannot manipulate figures or cheat you.

(all expenses are paid by operator out of HIS SHARE of income, hence you dont have to worry about any losses!)

3.

Audited Statement Every 3 Months

You will receive a Chartered Accountant’s report every 3 months showing complete revenue for the last 3 months from all rooms and of that, how much has been paid to you and how much to the operator – bringing total transparency.

No Chance of Delay!

Project is already 90% completed which means there is almost no chance of any delays

(if at all, it could be a delay of 1 to 2 months at most)

– Construction of structure is finished

(i.e. slabs, brickwork, plastering & painting are complete)

– Interiors are in progress

(wooden flooring & false ceiling almost complete, after which furniture will be installed)

Interior being done now…

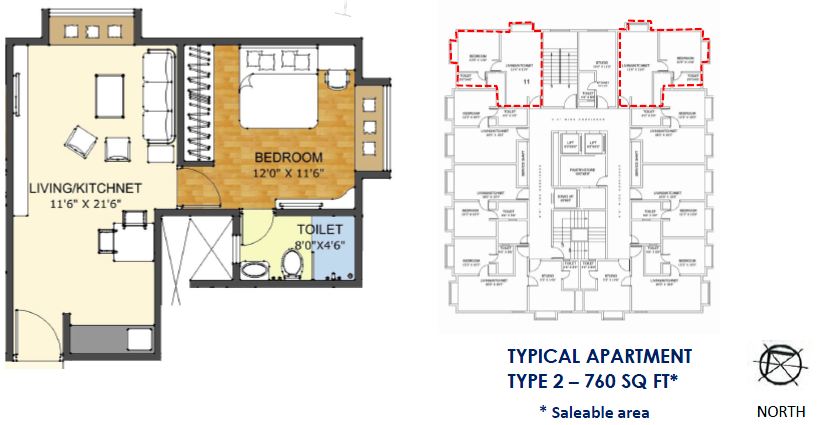

(shown above is a Premium 1 BHK of 760 Sft)

SAVE TAX on upto Rs.3,50,000 per Year!

Making this one of the most tax efficient investments in India!

– Upto Rs.2,00,000 under Section 24

– Upto Rs.1,50,000 under Section 80C

– 30% Standard Deduction on Rental Income

HOME LOAN AVAILABLE

By the 3rd year, income expected to be greater than your EMI, making this a completely self-sustaining asset.

– Pre-approved by HDFC, ICICI & Axis

– Upto 55% funded via home loan

– Pay only 45% from your pocket

(i.e. Rs.34 lakhs)

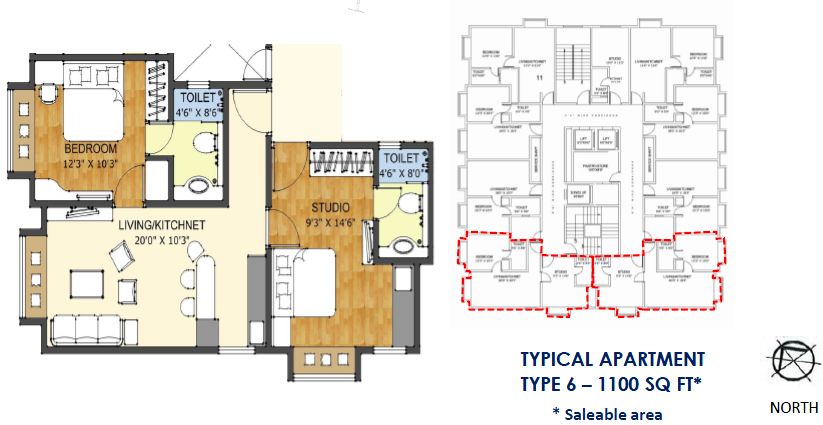

UNIT SIZE & PRICE

1 BHK Regular (675 Sft) : Rs.71.35 Lakhs

1 BHK Premium (760 Sft) : Rs.80.35 Lakhs

2 BHK Combo (1100 Sft) : SOLD OUT

this price is INCLUSIVE of

– complete furniture & fitouts

– registration & stamp duty

– GST & all other charges

You need just

Rs.14 lakhs to get started…

Hyderabad is the fastest growing IT Hub & office space market of India.

Global gaints like Facebook, Amazon, Deloitte, Qualcomm, Novartis, Apple, Uber & many more have made Hyderabad their base of Indian operations / headquarters.

This massive increase in employment has lead to tremendous demand for affordable serviced apartments like these, making this the perfect time for you to invest!

Invest today & start earning high rental income from end of August 2023!

Continue reading for a detailed explanation (location map, floor plans, income projections, payment schedule & more) and for questions & site visit, call +91 8500002480

Long Story

While we recommend you read the entire offer document in the order shown below, you can jump directly to a particular section by clicking on the topic of interest :

- What is this Starlit Suites serviced hotel apartment concept?

- Why should you invest in Serviced Apartments?

- How does Starlit Suites generate such high monthly income?

- How much will you earn every month?

- What makes this income so predictable & stable?

- Can you sell off this apartment after sometime?

- Where in Hyderabad is this located?

- Operator & Builder Profiles

- Financials – Unit Size, Cost, Payment Schedule & Home Loans

- Documentation involved & how to book your unit?

- Contact details of our team

Enjoy Stress-Free Rental Income!

Why go through all the stress & hassles of buying & renting out property on your own to ultimately earn just 2% to 3% per annum, when you can earn almost 3 times as much – i.e. 8% per annum – without any maintenance or involvement from your side by investing in these serviced apartments?

What is Starlit Suites / Serviced Hotel Apartment Concept?

Starlit Suites is a leading 3 star serviced hotel apartment operator of India and by investing in their hotel apartments in Hyderabad and other major cities, you can earn highest monthly income of Rs.50,000 to 55,000 per month on lowest investment of just Rs.71.35 lakhs (675 Sft, 1 BHK Regular) / Rs.80.35 lakhs (760 Sft, 1 BHK Premium).

HOW DOES THIS WORK?

- You invest in a fully furnished, fully air-conditioned and fully serviced hotel apartment (1 BHK / 2 BHK) that will be built to the standards of a 3 star hotel.

. - The unit is owned completely by you (registered in your name just like any other apartment) but is operated and managed by Starlit Suites Group and marketed to the leading Indian corporates and MNCs (incase of metro cities) and tourists & vacationers / pilgrims (incase of tourist or spiritual destinations like Shirdi & Tirupati) as a 3 star extended stay serviced hotel apartment.

. - The operator already has rate contracts and formal tie-ups with over 200 leading companies in India – including many Fortune 500 firms such as Cisco, Dell, HP, TCS, Wipro, Infosys, etc – who’s employees stay in these hotel apartments when they travel on work, thus giving the operator assured business / occupancy throughout the year.

. - Incase of spiritual destinations like Shirdi and Tirupati, the operator has tie-ups with leading travel agencies, online portals (like Makemytrip.com / cleartrip.com / booking.com etc) and event management companies to capture casual tourists / vacationers / pilgrims as well – in addition to corporates.

. - The total gross revenue generated by all the units in the entire hotel apartment tower is then shared in a 50:50 ratio between you (the investor/owner) and Starlit Suites (the operator).

. - This means you earn rental ROI of upto 8% in the beginning – which is 3 times greater than rental income from normal apartments or villas – and the income grows to as much as 15% per annum over time.

. - The operator Starlit Suites is a leading player in his category and is currently managing hotel apartments at Bangalore, Cochin & Delhi-Neemrana, with towers under construction at 6 more cities of India.

Continue reading to know more and also see the “ANNEXURE” section at the end of this offer document for exhaustive information on income projections, payment schedule, location map, floor plans and much more.

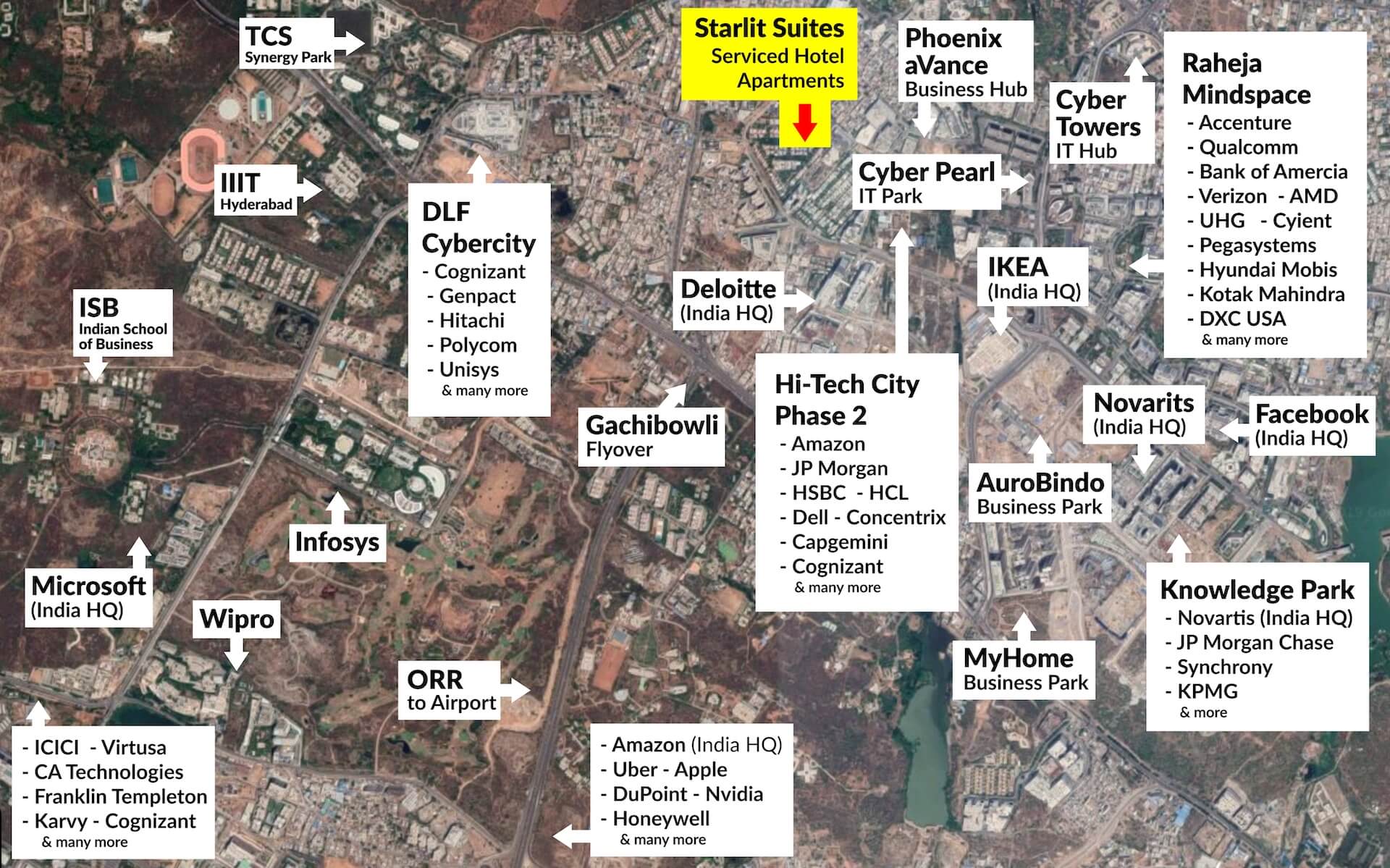

Located in the

Heart of Gachibowli

– Hyderabad’s IT & Pharma Hub

Located right at the meeting point of Gachibowli, Madhapur & Kondapur,

less than a Km from the ORR connecting to Hyderabad International Airport.

In Hitech City Phase 2, right next to Amazon, Deloitte & HCL Campuses

Shown below are some of the major companies / IT parks & landmarks in and around Starlit Suites Hyderabad – just imagine the tremendous demand for rooms from all these MNCs which are just 5 to 10 minutes driving distance from our tower!

and many many more!

Why should you invest

in Starlit Suites?

1.

Much Greater Rental Income than that of Normal Apartments

Purchasing a regular apartment and then renting it out will only give you 2% to 3% returns per annum. In comparison, serviced apartments give you 8% to 10% ROI per annum.

2.

NO Maintenance Charges + Stress-Free Management

These hotel apartments are managed & maintained completely by the operator at his cost – thus freeing you of the hassles involved in renting out property on your own.

3

Tried & Tested Model + Exploding Demand for Hotel Apartments

Over 380 investors round the world are already reaping benefits of this investment as Starlit Suites – with their rich experience of 37 years in hotel industry – has perfected this model over the last 6 years and is successfully operating 4 hotel apartments at Bangalore, Delhi-Neemrana, Pune & Kochi.

4

Highly Affordable Price & Relaxed Payment Schedules

Units priced at just Rs.71.35 to 80.35 lakhs, making this very affordable. You also get loans from HDFC & ICICI for upto 55% of unit cost, which means you pay just 45% or Rs.34 lakhs from your pocket and rest is funded by bank.

5

Timely & Automated Payment of Monthly Income to Your Bank Account

Each month’s income is credited directly to your bank account through ECS on the 25th of the following month, making collection of rent a stress-free and automated experience. You don’t have to worry about timely payments or collection and encashments of cheques etc.

6

Seven Days Free Stay across India

– You get 7 days free stay for 1 unit owned by you per year with complimentary breakfast.

– Out of this, 4 days can be at any location where Starlit is operating and balance 3 days can be availed at the location where you have invested (in this case, Hyderabad).

– You can accumulate the same for 2 years and also can gift free stays to family, friends and colleagues.

7

Asset Pays for Itself & Becomes Free in 8 Years

Unlike a normal apartment where EMI is 2 to 3 times greater than rental income, incase of serviced apartments, income is always greater than EMI and hence the project pays for itself and due to such excess income, you will recover your entire initial investment (i.e.40% of unit cost) within 8 to 9 years.

8

Chance to Acquire Property in Prime Locations

Apart from monthly income, you are also going to earn capital gains as you are acquiring an asset in very prime and key commercial localities of key cities of India. Normally, it would not be possible to acquire such prime property at such low ticket sizes and because of this, you will also enjoy tremendous capital gains in addition to high monthly income.

Construction is 90% complete

Trial runs expected to begin end of August 2023

The tower in the Middle is the Serviced Apartment Block – Starlit Suites Hyderabad is part of a 4 acre Gated Community consisting of 3 towers – 2 Residential (the towers on left and right) and 1 Serviced Apartment Block (in the center)

How does Starlit Suites serviced apartment generate such high monthly rental income?

- A custom designed serviced hotel apartment tower is constructed by a leading builder, with all the facilities of a 3 star hotel such as gym, pool, bar & restaurant, meeting rooms, etc.

The tower consists of a mix of Studio, 1 BHK and 2 BHK units (depending on demand in each market which varies from city to city) which are fully furnished to support extended stays with facilities like microwave, cooktop, fridge, etc.

. - Individual investors like you would buy 1 or multiple units which will be owned completely by you & registered in your name.

. - The price quoted is ALL INCLUSIVE – that is, basic cost of the unit plus cost of furniture, fitouts, taxes, deposits, registration and stamp duty.

. - You pay the total unit cost in instalments linked to progress of construction – which in this case is 3 months (since construction is already 90% complete).

. - You can get home loan for upto 55% of unit cost, which means only 45% is paid by you and balance is funded by bank.

. - At the time of booking your unit, you also enter into a 20 year RMA (i.e. Rental Management Agreement) with Starlit Suites, the hotel operator.

. - Once construction is complete, you along with all other unit owners in this hotel apartment will handover the keys of your respective units to Starlit Suites (the operator) on the basis of the above mentioned RMA for next 20 years.

. - Starlit Suites (the operator) will then bring in manpower and working capital to run this hotel apartment and rent out rooms / units for extended stays to employees of India’s leading corporates and MNCs (including Fortune 500 companies).

. - The operator has formal tie-ups / rate contracts with leading firms across India (such as Infosys, Wipro, Cisco, HP, Dell, HCL, TCS, Biocon, etc) which ensure continuous demand / occupancy for rooms throughout the year.

. - Incase of spiritual destinations like Shirdi and Tirupati, the operator has tie-ups with leading travel agencies, online portals (like Makemytrip.com / cleartrip.com / booking.com etc) and event management companies to capture casual tourists / vacationers / pilgrims as well – in addition to corporates.

. - The total gross income generated by ALL the units in the tower is then pooled into a SINGLE BUCKET at the end of each month and then 50% of such total income is distributed equally among all investors – ofcourse based on the size of unit / proportion of area owned by them in the tower.

. - Your share of the above 50% paid to all unit owners translates into annual returns of approx 5% in Year 1, 7% in Year 2 and 8% to 9% in Year 3 and this keeps increasing year on year to almost 15% p.a. by 20th year – which means 3 to 5 times greater rental income than that of regular apartments or villas.

.

- You earn income irrespective of whether YOUR unit is rented out / occupied or not

Since income of all rooms is pooled into a single bucket and then divided equally among all unit owners, you will earn as much income as any other similar unit owner – irrespective of whether your own particular unit is occupied or not.

. - No scope for operator to cheat you as you are getting 50% of TOTAL or GROSS INCOME

Since you and other unit owners are being given 50% of TOTAL / GROSS income – that is total revenue BEFORE any expenditure is deducted by operator – you will always earn high rental income irrespective of the expenses incurred by the operator.

. - Income is credited automatically to your bank account every month via ECS

Your income is credited directly to your bank account through ECS credit on the 25th of every month – which means absolutely no manual collection of rent cheques!

* For the 1st & 2nd year, you get 40% of total income and from 3rd year onwards, you get 50% of total income. This is done as operator incurs massive expenditure in marketing & promoting the new building in the beginning and is hence given 60% of the total income in the 1st & 2nd year and from 3rd year onwards, the total income is shared equally in a 50:50 ratio between you (the investor) and operator.

What is the rental income per month?

Income Projection Sheet

On average & in the beginning, you will earn approx Rs.50,000 to 55,000 per month on a 1 BHK of Rs.71.35 / 80.35 lakhs and over the next 15 to 20 years, this income will grow to as much as Rs.85,000 to 95,000 per month.

- A detailed Income Projection Sheet (PDF) is available in the annexures section at the end of this page and it shows you how much you can expect to earn per month from year 1 upto year 15.

. - This sheet is created by the operator, based on the occupancy levels he expects to achieve and the room rates he can charge based on the rate contracts that he has with his clients.

. - For this, operator has assumed average occupancy rate of just 70% throughout the lifetime of the property – which is a very conservative estimate as he is running his existing properties at a much higher 75% to 80% on average.

. - Even the room rates he plans to charge are very conservative compared to other hotels in the surrounding areas – infact Starlit gives you 2 to 3 times larger rooms for 30% to 60% LESS than comparable hotels.

.

- Click Here to view this sheet or scroll down to the end of this page and you will find the link to this sheet in the “Annexures” section.

Bigger Rooms

for Lesser Cost

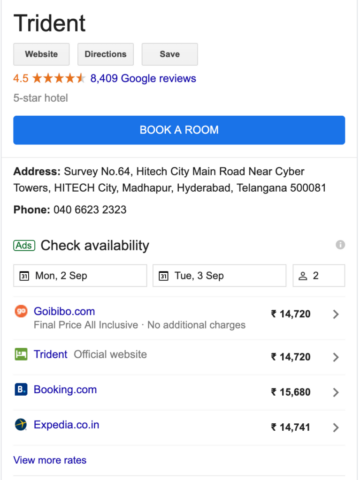

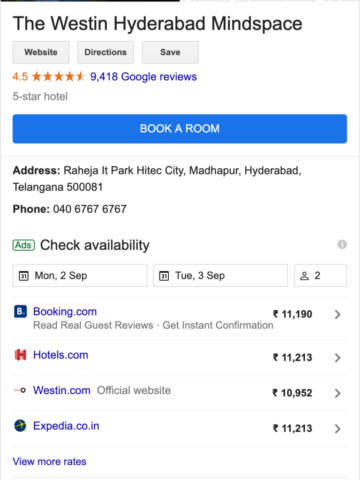

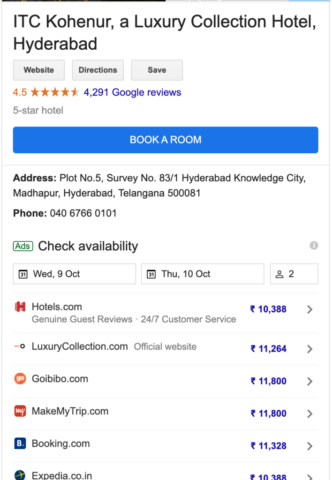

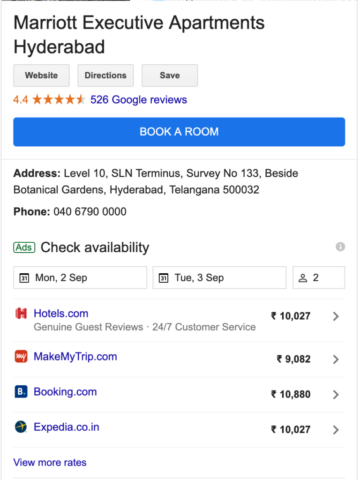

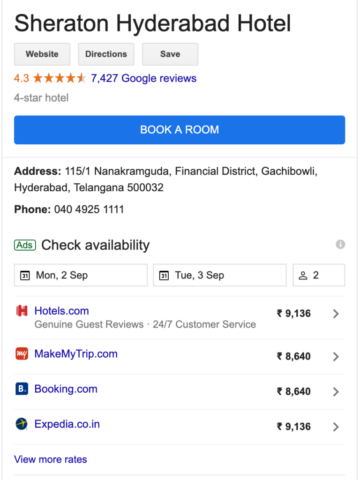

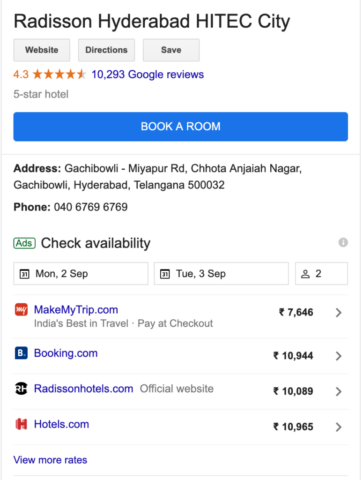

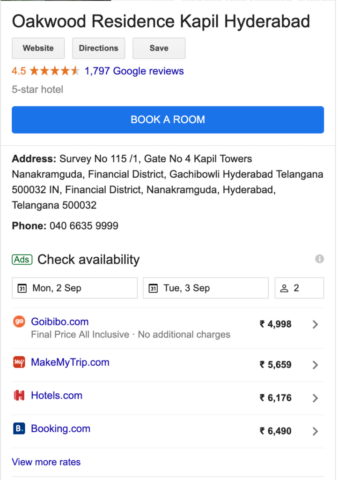

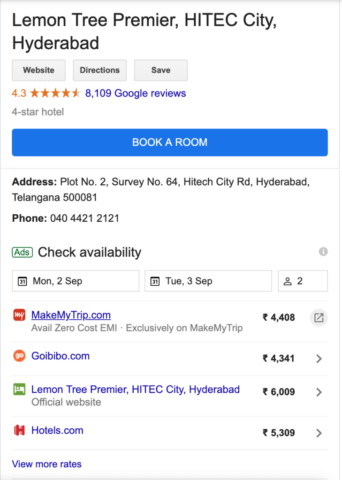

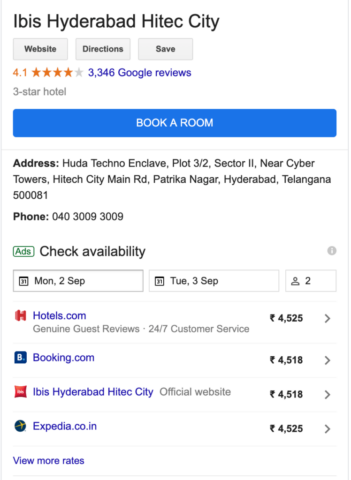

- In Gachibowli / Madhapur, a good 3 / 4 star hotels such as LemonTree Premier / Radisson Blu & Westin are charging Rs.4000 to 15,000 PER NIGHT for room that is on average 200 to 400 Sft in size.

. - Starlit Suites on the other hand is giving you a 1 BHK (675 to 760 Sft) / 2 BHK (1100 Sft) for an average rate of just Rs.4200 per night – which means you are getting 2 to 3 times larger room for 20% to 50% LESS than the cost of comparable hotels in the same area.

. - This makes Starlit Suites an incredible VALUE FOR MONEY option which attracts not only business travellers but also leisure travellers / tourists as well.

.

* Prices quoted here for comparable hotels are for a Double Occupancy Cancellable Booking with Breakfast. Many price comparison or online booking websites show prices that are EXCLUDING breakfast or NON-CANCELLABLE rates which might be misleading and hence always consider above when comparing prices with Starlit Suites. Such hidden charges could add as much as 20% to the basic cost of a room.

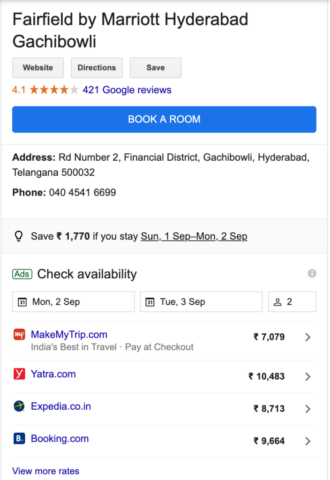

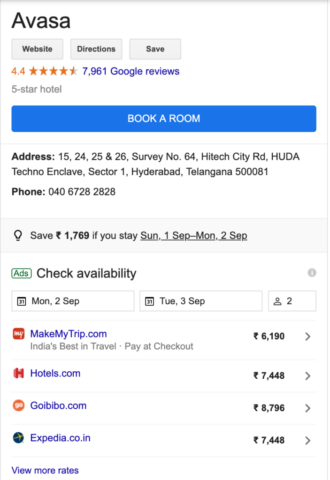

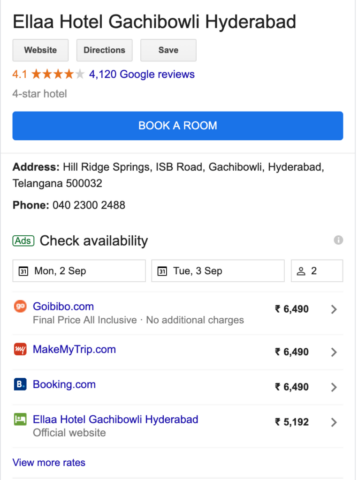

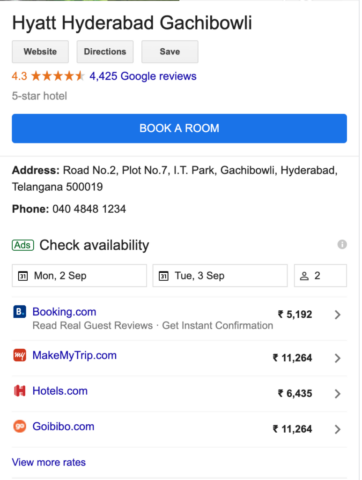

Look at what comparable top hotels in Gachibowli / Madhapur are charging as of today…

Shown below are screenshots of the world’s most popular hotel reservation website – booking.com where you can clearly see the kind of rates being charged by top comparable hotels in Gachibowli / Madhapur as of today.

Rates shown below are of Standard Double Rooms and Executive Double Rooms / Suite Rooms – which are comparable only to 1 BHKs in Starlit Suites Hyderabad.

Only one other hotel in Gachibowli / Madhapur has a 2 BHK option – the Marriott Executive Apartments which charges a whooping Rs.21,500 per night for a 2 BHK, whereas Starlit Suites Hyderabad will charge only Rs.6000 to 7500 per night for a similar sized 2 BHK.

Therefore, compared to rates of existing hotels, Starlit Suites is going to be much more affordable / cheaper despite providing the same quality of service, amenities and ambience.

Enjoy 7 FREE Star Nights per Year

You get 7 nights free stay per unit per year, with complimentary breakfast.

Out of 7 nights, 4 nights can be used at any Starlit Suites tower across India.

4 towers are currently operational, 6 under construction and 20 more in pipeline.

What makes this income so predictable and stable?

What is the guarantee that I will earn the income that is being showcased here?

This model is tried and tested and has been running successfully for the last few years at Bangalore, Cochin and Delhi-Neemrana.

The below features make it a fool-proof investment where all your interests are safeguarded & no one can manipulate your investment or its returns.

You Earn Income Even If your Room is Vacant

Since income from all the rooms is combined into a single bucket and then divided equally among all investors irrespective of whether their particular unit is rented out or not – you will still earn as much as every other unit owner in the building. Hence, you need not worry about whether your individual unit is getting rented out or not.

Stable & Predictable Demand Locked-In In Advance

The operator has already established relationships with over 200 MNCs – including many Fortune 500 firms – and signed formal rate contracts with many of them, which gives him assured business / occupancy for rooms throughout the year – which in turn means consistent monthly income for you.

Gross Income Sharing : No Scope for Operator to Cheat You

You get 50% of Gross Income – which is TOTAL INCOME BEFORE any expenses are deducted by the Operator – and hence there is no scope for manipulation and making your income independent of expenditure incurred by the operator. This means operator cannot inflate expenses and show less profit to try and cheat you etc.

Audited Statements Issued to You every 3 Months

Once every 3 months, you are given Audit Certificate (issued by a Chartered accountant) giving you details of the entire revenue generated by the building for each month and how that income is being split between operator and investors. This along with above aspect of sharing of gross income will ensure highest level of transparency as this leaves no scope for operator to manipulate accounts in any manner.

No Cash Transactions

Since payments are made by companies by RTGS / cheques or by employees’ credit card, there is almost NO CASH involved and hence no scope for operator to manipulate occupancy figures to hide any income. Even incase of bookings by casual travellers, systems have been put in place by the operator to eliminate any unaccounted occupancy.

No Maintenance Charges or Monthly Expenditure

Operator pays all expenditure out of his share of income – hence ZERO expenditure for you as investor

As an investor, you do NOT incur any expenditure for day to day management or operations of the hotel tower.

All expenses are incurred by the operator OUT OF HIS SHARE OF THE INCOME and hence such expenditure does NOT affect YOUR SHARE of income.

- OPERATING EXPENDITURE

Staff salaries, electricity & water costs, licenses, etc and all and any expenditure related to day to day operations are paid for by the operator out of his share of income and hence will not be paid or shared by you.

. - FURNITURE REPLACEMENTS

Your unit comes with furniture, appliances and fitouts included, which are executed by the operator to ensure highest quality. Incase of any damage to the items, they are replaced at the cost of the operator and hence you as an investor need not worry about the quality and safety of your furniture or having to pay for repairs and replacements etc.

. - INTERNAL MAINTENANCE

The operator takes complete responsibility for maintaining the property on the lines of a 3 / 4 star accommodation AT HIS COST to ensure highest occupancy. This automatically ensures the highest upkeep of your property and strong capital values and appreciation.

** SINKING FUND **

- To keep the hotel fresh, new and relevant to changing tastes and amenities, the operator carries out overhauls / upgrades of major equipments and amenities of the hotel (such as lifts, carpets, exterior facade, power back-up generators, etc) which needs a significant investment once every 8 to 9 years.

- Instead of expecting investors to invest once again out of their pockets, the operator creates a corpus of funds by setting aside 3% of your share of income into a separate account called a “Sinking Fund”.

- This money & the interest earned on the same belongs to you and all the other investors jointly is used to make such large changes and overhauls.

- This way, you will not have to invest extra money once every 8 to 9 years which is very important and has to be done to keep the building and rooms attractive to guests in the long run.

Is there enough demand for serviced apartments in India?

A growing number of business travellers / companies & tourists prefer staying in serviced apartments than hotels because…

For Travellers

- The operator’s main target is the corporate traveler who travels for training, conferences, exhibitions, short-term projects, etc. where typical stay lasts for 10 to 14 days on average and can extend up to as much as 6 months to 1 year in some cases.

. - Another big target segment are employees who have been relocated to a new city or fresh hires who are being given 15 to 30 days of free accommodation by their employer.

.

- Incase of spiritual destinations like Shirdi and Tirupati, even casual tourists / pilgrims are increasingly preferring serviced apartments as rooms are 2 to 3 times larger and more importantly, 30% to 50% CHEAPER than hotel rooms.

. - Such long term travellers always prefer a serviced apartment over a regular hotel because they can cook their own meals, order room delivery of food from their favourite restaurant and entertain guests in their rooms – which is not possible in star hotels.

. - And they can enjoy all of this with an ambiance similar to a 3 star hotel, but in much bigger rooms with more space – giving them a comfortable “home away from home” feel.

For Companies

- After salaries and office rent, the 3rd biggest expenditure for companies are employee travel related costs.

. - Serviced apartments are 30% to 40% cheaper than hotel rooms, which results in tremendous cost savings for companies – especially when employees travel for extended periods.

. - The operator also complies with their requirements for fire and safety measures, ensuring highest safety for their employees in line with corporate insurance policies.

. - This coupled with close proximity of these hotel apartments to major IT/ITES, finance & other business hubs, is greatly contributing to the increasing demand for such corporate serviced residences across India.

Operator Profile and Experience

Starlit Suites – India’s No.1 extended stay serviced apartment operator

To understand their leading position in India in this segment and their unique strengths to ensure good monthly income in the long run, click here to read their profile.

- There are NO organized or established serviced hotel apartment chains / operators in India, that too with multiple properties across the country.

. - Existing serviced apartments are fragmented, unorganized and mostly run by individuals or part time players who have no expertise in the business and are limited to just one location or city.

. - Starlit Suites is the first organized & branded player in the Extended Stay Segment across India with properties in multiple cities (4 operational, 6 under construction and 20 more in the pipeline) and is hence leading the market.

. - Other hotel brands are focused entirely on the Short Stay Segment which is completely different and DOES NOT COMPETE or COMPARE with serviced apartments – as the target customers, pricing, duration of stay, facilities provided are completely different in both these industries.

. - Starlit Suites focuses purely on Extended Stay segment for corporate travellers which has a much larger audience + consistent, predictable and growing volumes year after year.

Can you sell this apartment after sometime & exit?

YES you can.

You can sell your unit to anyone at any point of time and exit with substantial capital gains, in addition to the monthly income that you would have earned until then.

Massive Demand for High Monthly Income Assets

- Current FD rates in India are at an all-time low of 5.7% per annum and are set to fall further to as low as 4% over the next few years.

. - Rental income from residential property is a minuscule 2% to 3% and falling.

. - Commercial property may give you 7% to 8% ROI but they need a much larger investment of Rs.3 to 5 crores which is impractical for most of us.

. - So people will happily buy any asset that gives you more than 8% to 9% ROI – which Starlit Suites exceeds by a large margin as it gives you 8% to 10% in the beginning which grows to as much as 15% by 15th year.

. - Investors would queue-up outside your door to buy such a high income generating asset from you as there are no other safer, stable and predictable income alternatives in India.

Greater Appreciation than Regular Apartments or Villas

Since these apartments are fully furnished, fully air-conditioned and fully serviced and come with a long lease with high monthly income, they will appreciate a lot more than regular apartments or villas.

Home Loans make it Very Affordable

Small ticket sizes and availability of home loans make these highly affordable and easy for anyone to invest in Starlit Suites, because of which there is massive demand for such assets – making it easy for you to sell whenever you want to.

Constant Waiting List for Resale Properties

We receive enquiries on daily basis from many investors who are eager to purchase such high income assets and hence reselling your unit will be easy due to such waiting list that builds up in each city. For example, at Bangalore where we did our first tower (126 room hotel at Electronic City), we have a waiting list of over 11 people who are eager to buy any unit that may come up for resale.

Buyer Gets Income from Day 1 of Investment

The person who is buying this asset from you would start earning rental income immediately (i.e. from Day 1 of his investment) and thus would be willing to pay you a premium to buy such a proven asset from you. You can also show your bank statement as a proof of income being generated by your unit.

Seven nights FREE Stay @

ANY Starlit Suites property across India

With breakfast!

- For every unit you own, you get 7 nights of FREE stay with breakfast PER UNIT PER YEAR.

. - Out of these 7 nights, you can spend 4 nights at ANY OTHER Starlit Suites location (currently operational at 4 locations, 3 more to get added by end of 2021 and 20 other cities eventually over the next 8 to 10 years).

. - That is, if you invest in Starlit Suites Hyderabad, you can use all the 7 free nights at Hyderabad or use upto 4 nights at any other location such as Bangalore, Shirdi, Tirupati, Delhi-Neemrana, Pune, Cochin, Kolkata, Trivandrum and balance 3 nights at Hyderabad.

. - You can also gift these free nights to your family, friends and colleagues and any unused free nights can be rolled over to the next year (for a maximum of 2 years).

Asset becomes Free in 8 to 9 Years

You will recover your entire investment in 8 to 9 years

- When you invest using a home loan, the income from these hotel apartments will be greater than the EMI you pay on your loan.

. - This is because your EMI is calculated at 6.7% (current floating rate) on 60% of unit value, whereas you are earning income of 8% to 10% on 100% of unit value.

. - For example, when you buy a Rs.71.35 lakh 1 BHK by taking 60% loan which is Rs.44 lakhs, your EMI would be approx Rs.36,000 per month, whereas income in Year 1 itself is Rs.35,000 per month and by 3rd year, you are earning Rs.50,000 per month – which means you are left with profit of Rs.14,000 per month approx EVEN AFTER paying off your EMI.

. - Because of this excess income (which keeps increasing every year as EMI remains same but income keeps increasing), you will accumulate enough funds to recover your entire investment of 40% in 8 to 9 years time.

. - Post this, you will continue earning monthly income FOR FREE as technically, you are earning this on ZERO investment (as you have recovered your entire initial investment).

. - Therefore, investing in this hotel apartment using a home loan is the smartest way to create wealth and earn higher ROI in the long run.

. - Even if you can afford to pay the entire cost of unit from your own funds, it is financially more lucrative to invest using a home loan.

Invest in Starlit Suites Hyderabad if…

- You want to generate an increasing & continuous stream of high passive income to supplement your primary source of income and elevate your lifestyle.

. - You want to build a secondary source of income as a back-up / insurance against job loss, etc in these increasingly uncertain times.

. - If you dream of retiring early or are on the verge of retirement and want to create a steady stream of stable, predictable and high monthly income.

. - If you are an NRI yearning to return to India but are unsure or have no safe way to generate a consistent monthly income to maintain your current lifestyle that you enjoy abroad, once you are back in India.

. - If you are an NRI who has settled abroad and decided not to come back to India forever but want to take advantage of India’s booming economy and real estate story – for which this asset is the best way to participate in India’s growth.

. - If you dream to own a chain of hotel rooms across India by investing in multiple micro assets across top cities of India instead of sinking all your money into a single asset in just one city.

. - If you want to own an asset that is entirely managed by India’s leading professionals rather than having to manage them yourself.

. - If you have already retired and want a safe investment that can generate monthly income without having to lock-in your capital for a long time, which is the case with most of the options available today such as FDs, Provident Fund, finance or chit fund companies which provide low monthly returns, no capital appreciation and also block your funds for a very long time.

Enjoy Stress-Free Rental Income

Why go through all the stress & hassles of buying & renting out property on your own to ultimately earn just 2% to 3% per annum, when you can earn almost 4 times as much – i.e. upto 8% to 10% per annum – without any maintenance or involvement from your side by investing in these serviced apartments?

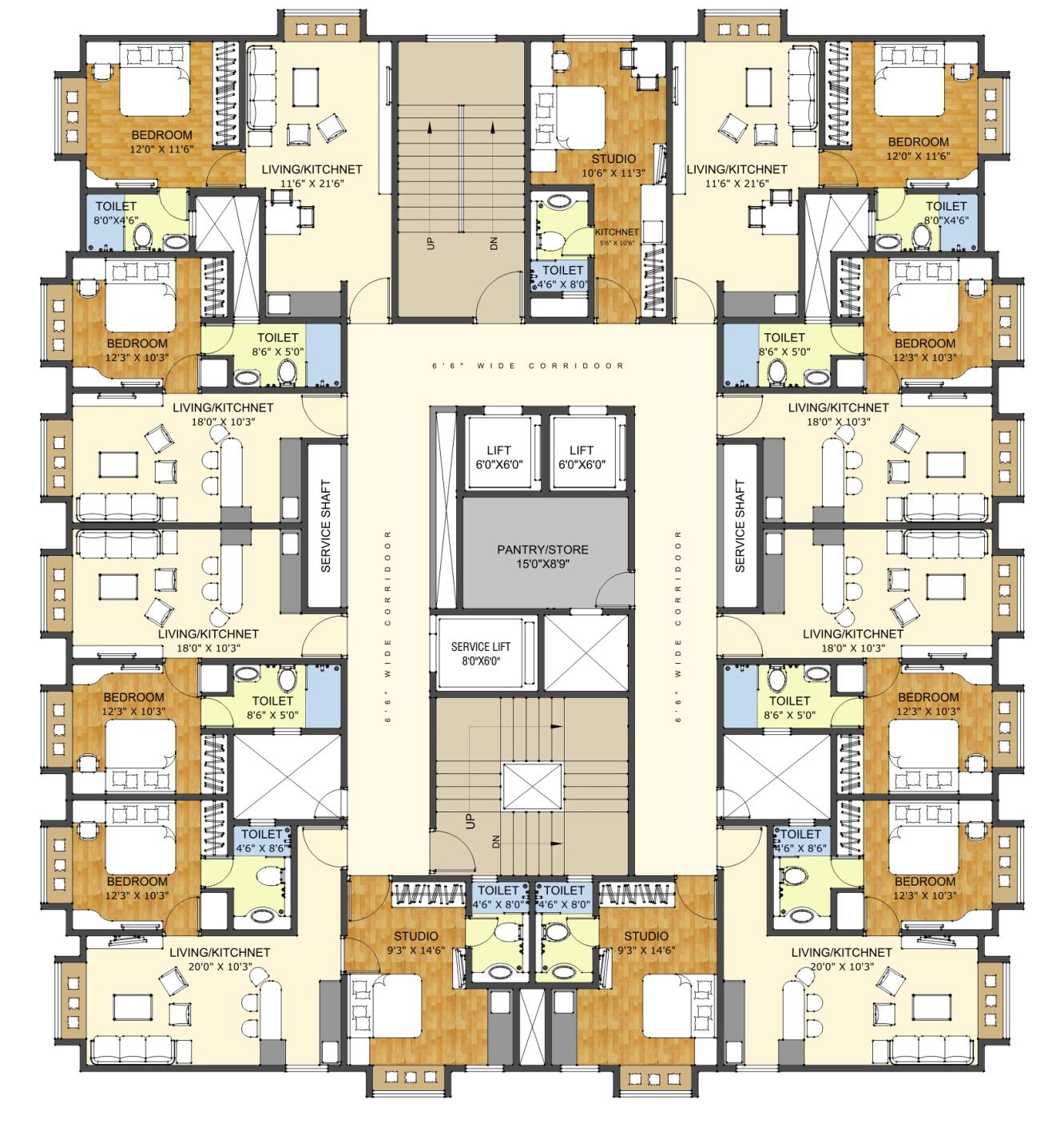

Project Overview

LOCATION

Located in Hitech City Phase 2, near Raheja Mindspace / Cyber Pearl IT parks, next to HCL & Amazon Development Center and neighbouring Rolling Hills villas, Ramky CEO Enclave, Meenakshi Trident Towers & Ramky Towers (off the Kondapur – Gachibowli Road).

SIZE OF PROJECT

Ground + 19 Floors

Part of a 4 acre mixed development project with apartments

TYPE, SIZE & COST OF UNITS

– 1 BHK (675 Sft) : Rs.71.35 Lakhs – 4 Units Left!

– 1 BHK (760 Sft) : Rs.80.35 Lakhs – 1 Unit Left!

– 2 BHK (1100 Sft) : Rs.1.16 Crores (SOLD OUT)

EXPECTED COMPLETION DATE

Construction is almost complete, trial operations will begin by end of August 2023

SANCTION / APPROVAL STATUS

All Approvals Received & Project Pre-Approved for Home Loans from HDFC, Axis Bank and few more.

Location Advantage

Where in Hyderabad is this located?

Located in the heart of the IT Hub – Gachibowli, Starlit Suites is 5 to 10 minute driving distance to all major IT parks, SEZs, elite schools/colleges, hospitals and shopping malls. Adjacent to the Rolling Hills Villa Project, it is within 10 minutes of Cyber Towers, Raheja Mindspace, Deloitte, E&Y, TCS, WIPRO, ICICI, Microsoft and many more major workspaces.

It is just 500 meters from the Outer Ring Road which takes you to the airport in 30 minutes. And just 15 minutes from one of India’s biggest convention centres – HITEX (located on a 50 acre campus with a International Crafts Bazar and International Auditorium, Shilparam).

This site has direct driveways towards all directions from the project towards :

- NORTH : M.M.T.S. Stations ( Hi-Tech, Hafeezpet and Fatehnagar), J.N.T. University, B.H.E.L., etc.

- SOUTH : ORR, Shamshabad Airport, Narsingi, Manikonda, Vikarabad road, Gandipet Road, etc.

- EAST : Meenakshi IT Office and Residential Project, Mind Space, In orbit Mall, Gatchibowli Road, Mehdipatnam, Secunderabad, Jubilee Hills, Banjara Hills, etc.

- WEST : IT Companies, Financial District, ORR, Old Bombay Pune Highway, Botanical Gardens, Central University, etc.

All above developments have resulted in a huge demand for quality hotel / serviced accommodations. This project aims to address this un-met demand for quality hotel/serviced accommodation facilities at an affordable price – right in the heart of the hottest growth corridor of Hyderabad.

Builder Profile

This developer is one of India’s largest infrastructure development companies with an order book of over Rs.12,000 crores across the globe.

They have a highly accomplished and successful track record in heavy engineering and construction projects spanning 6 decades.

With more than 78 dams globally, 40 hydro power projects, 33 micro tunneling projects covering more over 175 kms, and an annual turnover of over Rs.2500 crores, this developer is extending it’s foray into residential spaces backed by sound technology and profound knowledge & experience of the real estate needs of each region in India.

FINANCIALS

Price, Payment Schedule, Booking Amounts & Loans

Affordable Prices & Unit Size

1 BHK (675 Sft) : Rs.71.35 Lakhs – 4 Units Left!

1 BHK (760 Sft) : Rs.80.35 Lakhs – 1 Unit Left!

2 BHK (1100 Sft) : Rs.1.16 Crores (SOLD OUT)

These figures are of :

– Inclusive of all furniture and fitouts as per list available in Annexure section at the end of the page.

– Inclusive of GST, Registration and Stamp Duty as applicable on date of registration (subject to changes by govt from time to time)

– Exclusive of G&C’s service fee of 1.5% on the basic value (read more about this here)

Unlike other apartment projects where you are charged an extra premium for floor rise or premium location etc, there are no such extra charges in this hotel apartment and everyone pays the exact same cost irrespective of floor, facing or position of your unit in the tower.

This ensures that everyone in the apartment earns equal returns irrespective of unit position.

Starlit Suites seems Expensive compared to regular apartments?

Starlit Suites may seem expensive when compared to regular apartments in the surrounding areas but you can click here to see a price comparison sheet which clearly shows how Starlit Suites is actually CHEAPER than regular apartments in this area.

In regular apartments, you are quoted a basic price + many other premiums, deposits and extra charges which add almost 15% to 20% to the total price of the unit.

There are also no extra or hidden charges such as car parking, club house charges, 100% power backup deposits, advance maintenance deposits, etc etc.

Easy Payment Schedule

- Booking Amount :

20% on booking.

.. - Balance 80% :

– Incase of self funding, another 75% is due within 3 to 4 weeks and balance 5% at the time of registration (expected in few weeks from now).

– Incase of home loan funding, upto 55% will be funded by bank* which means another 25% is due from your pocket, out of which 20% due immediately and last 5% at the time of registration (*subject to your individual eligibility).

Home Loan Available

- Upto 55% of unit cost can be funded via the loan which means you pay only 45% out of your pocket.

.

- Entire loan process will be handled in-house by us on your behalf so you dont have to spend time and energy in running around banks etc.

. - TAX BENEFITS : The EMI paid on the loan can also be written off against the income earned from this asset, which effectively reduces your taxable income.

Income is Credited to Your Bank Account Every Month (via ECS)

Each month’s income is credited directly to your bank account on the 25th of the following month and hence there is no need for you to monitor or follow-up for collection of income.

Returns / ROI

While a detailed “Income Projection Sheet” is available in the annexures section, given below is a quick summary of returns you can expect to earn – based on very conservative occupancy and room rates assumed by the operator which we have also validated at our end, based on existing market rates of comparable hotels in the area) :

- 5% to 6% p.a. in 1st year of operations (and this does not include the abrupt hike in capital appreciation of asset in the first 3 years)

- 8.7% to 9% by 3rd year

- 11% to 12% p.a. by 10th year

- 14% to 15% p.a. by 15th year

If you take into consideration the high initial appreciation of capital values in the first 3 years and considering that the asset value might almost double in 4 to 5 years, you may end up earning an average ROI of 30% in 1st and 2nd year alone and hence this is a NO – BRAINER Investment.

Documentation Invovled

-

Sale & Construction Agreement (SCA)

This is between you and the builder for purchase of the flat and covers the terms and conditions of sale and construction of the hotel apartment and the timelines involved. This agreement will also have clauses to compensate you incase of delays in construction.

. -

Rental Management Agreement (RMA)

This is between you and Starlit Suites (operator) and captures the terms and conditions of the revenue-sharing agreement with the operator. It contains important clauses related to revenue sharing, operator’s responsibilities, complimentary stay, period of contract, etc.

. -

Furniture & Fitouts Agreement (FFA)

This is between you and Starlit Suites (operator) and it covers the cost and schedule of items that will be included as part of furnishings of your room as per 3 star hotel apartment standards.

. -

Power of Attorney (POA)

This is a legal document giving Starlit Suites the power to operate the unit on your behalf and is a matter of legal formality.

Booking Your Unit

The booking process is fairly simple as explained below :

Step 1

Please inform one of our team members who will send you the booking form, which you can fill and send back a soft copy along with details of payment of booking amount which you can pay via net banking or by issuing a cheque.

Step 2

Based on your preference if any, a short list of available units will be sent to you and you can choose from the same to proceed further. All units are priced the same and the returns are distributed equally and hence you can choose any unit out of whatever is available without bothering too much about floor or facing.

Step 3

In addition to booking amount, once you pay 20% of unit cost, agreements will be printed and issued to you for signing, post which they will be sent back to builder for execution and you will be given your set once builder signs the agreements.

Step 4

Balance 80% may be paid as per payment schedule and incase you are going for loan, the same will have to be disbursed right away. Please contact Jhashank on +91 8500002480 / jhashank@gcglobal.in for further info or assistance on loan application process and to get a free estimate of your loan eligibility.

Important

Annexures

Click on below links to view additional important information about this high monthly income project in Hyderabad :

Contact Details

For bookings or queries please call any of our below team members :

INDIA

Jhashank Roy Chowdary

jhashank@gcglobal.in

+91 8500002480

USA

Divyendhu Chowdary

adrc@gcglobal.in

+1 845 248 0012

Invest in Starlit Suites Hyderabad and start earning from end of August 2023!

If you have more questions, visit our FAQ section by clicking here or

call one of our team members displayed above.